Transportation Trends: November 28 2022

TLI's Weekly State of Transportation Update

General slow-down in freight volumes may set shippers up for success next year. Rail strike still looms as normal seasonality trends return with Christmas Tree shipping.

General:

All indicators have been pointing towards a slow down in freight volumes in the past couple months. October showed a year-over-year drop of 53% in spot loads, according to DAT trendlines. Imports are also showing signs of slow down as container volumes dropped 23% since August’s all-time high container volumes. This is due to excess inventories and less demand for imports as warehouses were overfilled.

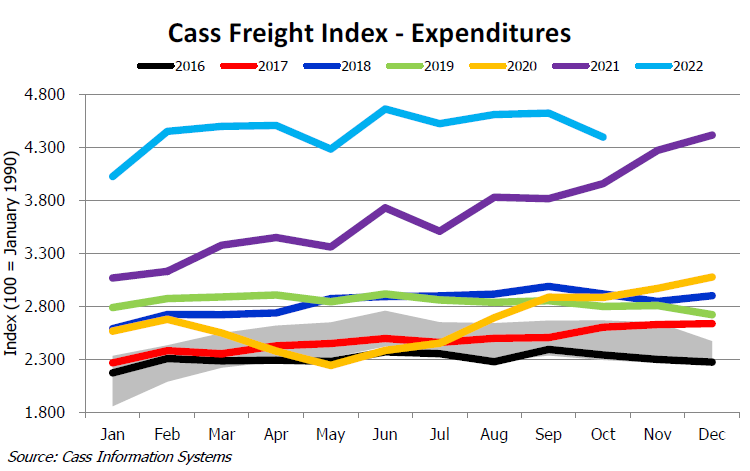

Transportation costs remain higher amid these slowdowns. There are many reasons including the LTL contract environment and contract vs spot load pricing. However, experts are predicting a slow down in costs as well into the next year.

Rail:

In late September, a deal was proposed from the White House to avoid a rail strike. On Monday, a major labor union rejected to deal setting up for a new deal deadline of December 8 deadline. Any disruption to the rail industry would be substantial to the supply chains’ OTR trucking demand and is worth keeping an eye on.

Currently, President Biden asked for Congress to intervene to help avoid the looming strike. The cut off date is still set for midnight of December 8 to reach an agreement.

Truckload:

Seasonal trends appear to be back regarding Christmas tree shipping. The largest Christmas tree supplier, Portland OR, spot market volumes increased by 11% week-over-week as the live Christmas tree demand rose for the holidays. Fake Christmas trees were being imported earlier this year as the scarcity of 2021 showed the need for early importing.

Truckload load postings decreased 45.5% week-over-week due to the holiday last week. At the same time, spot truck posts decreased 33.7%. Activity remained low as shippers and carriers took the holiday break. Dry van rates increased slightly (2%) last week due to tighter capacity.

Less-than-Truckload:

Our team has noticed carriers becoming less selective on freight as volumes trend downward. In the past two years, carriers were more inclined to skip on unattractive freight as their networks were full. However, if the freight helps fill out a specific lane, they will be more open to accepting the freight. They are still focusing on dock-to-dock operations as preference.

LTL carriers are continually working through capacity issues on a terminal, shipment, and day-to-day basis. Weekly updates/directions are given by carriers to help alleviate their terminal which may include: freight embargos, dimension/quantity restrictions, and transit delays. TLI is actively monitoring these situations and will update any affected customer with solutions.

TLI is actively monitoring situations in the industry, such as acquisitions, embargos, and other industry disruptions. If a TLI client is directly affected by any of these events, your TLI representatives will reach out to discuss what this means for your account.

TLI highly suggests that on all shipments you provide our team with the “Must Arrive by Date” (MABD) as to when you need the product delivered. This will help us select the proper transit time / equipment type at the best current freight rate.

Please contact your Translogistics team at 610-280-3210 for any further questions.

*article written by Mitchell Kinek, Sales/Marketing Executive, Translogistics. Any questions, please do not hesitate to reach out!

TLI Chart of the Week

TLI Insights

Get the latest logistics insights and tips from TLI's award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@shiptli.com