TLI Transportation Trends - March 2024

Transportation Trends Update 2024

March 2024 Logistics Industry News

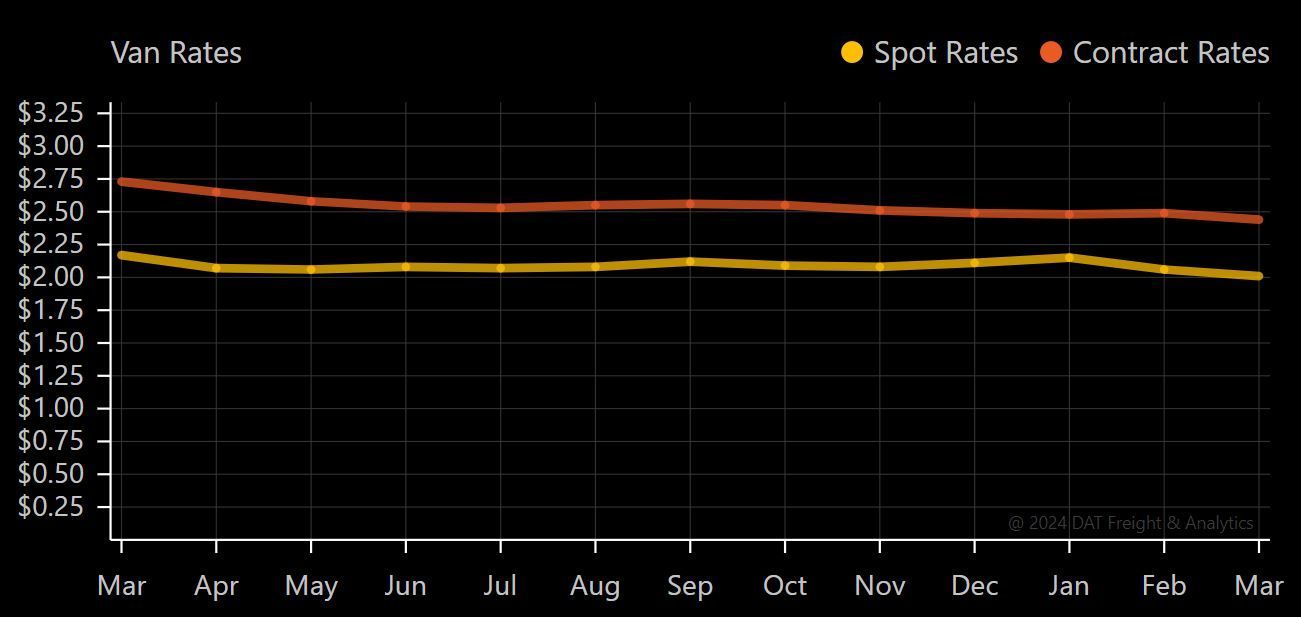

While national averages for van and reefer rates experienced declines in February compared to January, with all-in prices dropping by 9 cents and 15 cents respectively, the flatbed segment bucked the trend with a modest 2-cent increase.

FTL Pricing

Average full truckload (FTL) rates, excluding fuel and accessorial fees, experienced a 0.6% monthly decrease in January and are down 8.6% year-over-year. With softer freight demand, both spot and contract rates continue their downward trajectory. TLI's analysis indicates trucking improvement will likely be deferred until mid-2024, around September or the late third quarter, following an anticipated 25-50 basis point drop in the federal funds rate. Dry-van truckload spot rates, including fuel, through mid-February are down 3% year-over-year and trending at a trailing 6-month average. While rates appear below break-even profitability, our work suggests pricing remains under pressure, excluding weather events, as trucks run to cover cash flow.

During January 2024, freight shipments across all domestic modes were down 7.5% year-over-year and down 3.5% month-over-month due to normal seasonality, according to Cass. Our analysis indicates inventory destocking will remain a key theme during the first quarter, as end-demand remains tepid. Flatbed pricing is down 8.4% year-over-year; however, it rose 0.4% on a month-over-month basis. Refrigerated spot truckload rates are down 6.8% year-over-year. Currently, TLI is having an easy time sourcing loads in most markets, as load postings are down 28.2% month-over-month and down 11.9% year-over-year. Fuel is likewise down 8.4% year-over-year, further reducing the total cost of shipments. This presents an excellent market opportunity for shippers to work with TLI!

Current Economic State of US Manufacturing

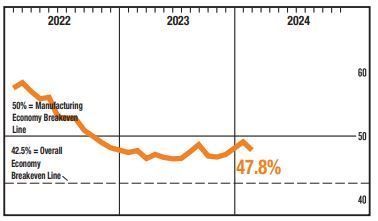

The manufacturing sector in the United States continued its downward trajectory in February, with the Manufacturing PMI registering at 47.8 percent, a decrease of 1.3 percentage points from January's reading of 49.1 percent. This marks the 16th consecutive month of contraction for the sector. Four out of the five subindexes that directly contribute to the Manufacturing PMI are now in contraction territory, an increase from three in January.

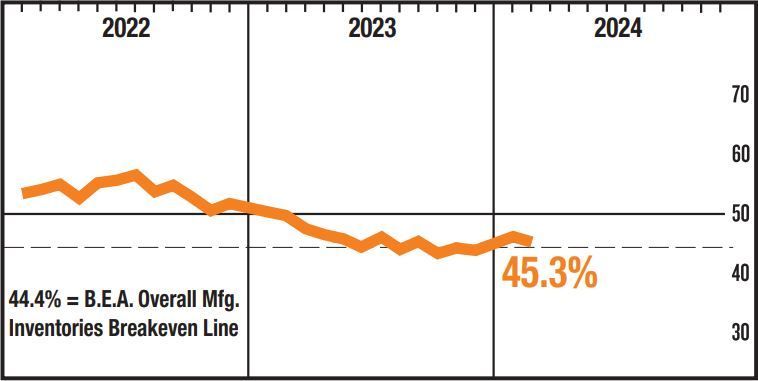

The Retail Trade Industry had been engaged in an active destocking cycle for 9 months consecutively. It appears to be transitioning into the passive destocking phase in the third quarter of 2023. Historically, retailers take an average of 12 months to actively destock and an average of 6 months to passively destock. This suggests that destocking activities among retailers are likely to continue into the first quarter of 2024. The industry could potentially transition into active restocking during the tail end, of the first half of 2024.

The New Orders Index, after a brief respite in expansion territory, dropped back into contraction. Notably, Inventories recorded the lowest reading on the report at 45.3, indicating that they have been contracting for the 13th consecutive month, and at an accelerated pace.

Less-than-Truckload

Ward Transport & Logistics fell victim to a cyber attack that targeted multiple layers of their network on the morning of Sunday, March 3, 2024. The company's technology department is worked diligently to resolve the issue. As a result of the Ward Trucking cyber attack, the less-than-truckload (LTL) carrier will be operating with limited capacity, handling only the freight already within their system.

Ward is not the first LTL carrier to suffer from a cyber attack. In October 2023, ESTES Express Lines experienced a similar incident, which had lasting impacts on their operations due to the critical role technology plays in carrier operations, customer tendering, freight tracking, and various other aspects.

As far as the economic state of the LTL market, TLI's LTL industry contacts noted an improvement in demand during January after experiencing 10 consecutive months of declines due to the closure of Yellow in late July. Forward-looking commentary on organic demand indicates that inventory destocking continues to weigh on the overall less-than-truckload (LTL) demand. However, the reduced capacity resulting from Yellow's 8-10% market share departure has provided greater market share opportunities for other LTL carriers. The momentum in LTL pricing has reversed course over the last 45 days, with fewer contacts reporting price discounting from LTL carriers, as their networks are now filled with the gained market share from Yellow. CRC is expecting LTL pricing to likely increase by 4-6% in 2024.

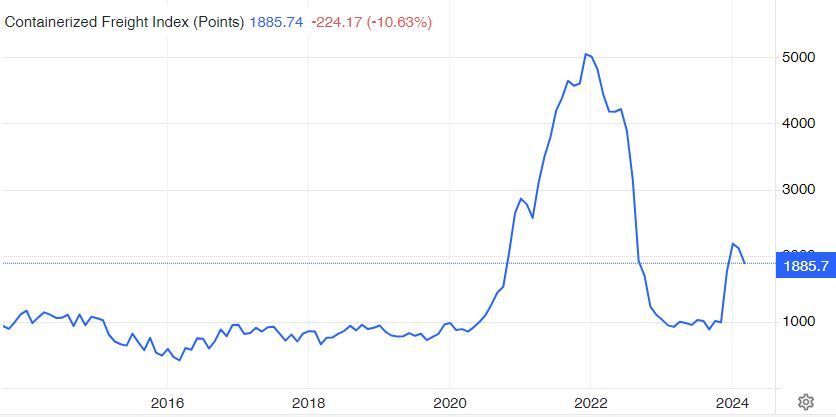

International Shipping

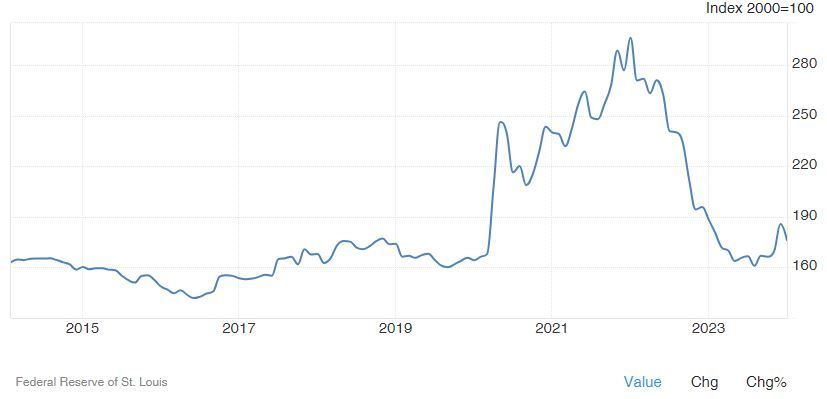

Over the past 30 days, the Containership Lease Rate Index (based on lease rates for ships) has experienced a slight deceleration. Weaker ocean demand has led to reduced pricing and ship profitability, while overall capacity has become more readily available. Although lease rates remain significantly above pre-COVID levels, likely due to longer-term lease contracts signed, we anticipate this situation to normalize over the next 12 months or more as contracts expire and market conditions continue to evolve.

Inbound Price Index of International Air Freight Services

TLI Insights

Get the latest logistics insights and tips from TLI's award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@shiptli.com