Freight Insurance That Works for You with TLI Advantage+

Shipping goods shouldn’t feel risky. With

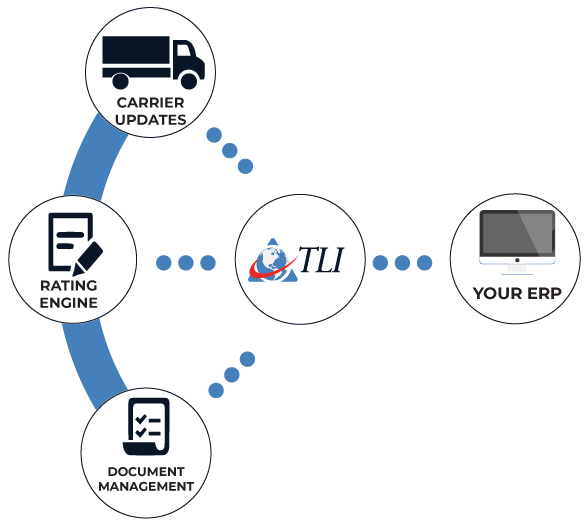

TLI Advantage+, you can secure affordable, full-value freight insurance during your normal BOL order entry. The process is fast, easy, and fully integrated into our ViewPoint TMS platform. You simply enter the shipment’s value, and our system does the rest—automatically calculating the carrier’s limited cargo liability and securing additional coverage on the fly.

This coverage goes beyond the carrier’s minimum. You enjoy broader protection with fewer exclusions,

powered by Redkik and Falvey. This is peace of mind, built into many

modes of transportation including LTL.

TLI is not an insurance company—rather

we’re the highest rated 3PL on Google, offering real protection through industry leaders. Our TLI Advantage program ensures you receive the best insurance coverage option available, without having to shop around. For our shippers, it means more security, fewer claims headaches, and reduced financial risk.

More Time to File with TLI Advantage+

Why Shippers Need More Than Carrier Liability

I recommend thinking of this additional freight insurance coverage as an extra layer of security that protects your bottom line. Whether you're moving a custom mold, critical raw material, fragile electronics, machinery, or anything with a high replacement cost, skipping coverage could cost you far more in the long run.

Standard Industry Coverage

**Actual coverage varies depending on motor carrier

Multi-Modal Freight Insurance Made Easy

As we reach the halfway point of the year, over

$177 million in additional insurance has already been purchased to ensure full coverage for shipments in transit. This milestone reflects the trust our clients place in our commitment to protecting their freight every step of the way. Whether navigating high-value loads or mitigating unforeseen risks, our insurance solutions continue to provide peace of mind and critical financial protection across the supply chain.

TLI Advantage+ covers much more than LTL. While it's built into ViewPoint TMS for LTL moves, your rep can help you protect shipments across all modes:

- Less than Truckload (LTL)

- Volume LTL

- Partial Truckload (PTL)

- Truckload (TL)

- Intermodal

- Expedited

- International Cargo

Pros and Cons: Should You Add Freight Insurance?

This isn’t a cookie-cutter freight broker insurance add-on. TLI Advantage+ is a powerful risk management tool for shippers who care about reliability and cost control. This solution is built directly into the BOL order entry, providing you a simple and fast way to add coverage. You get access to high-quality policies underwritten by proven providers—without having to learn the ins and outs of the insurance world. Likewise, since it is built into the BOL order creation you do not need to juggle an entirely new system or onboard another process or vendor.

Understanding Deductibles and the Claims Process

TLI Advantage+ freight insurance includes a deductible based on your shipment’s category. This is the portion of a loss you’re responsible for before insurance coverage applies, if a claim is filed. While deductibles vary by commodity type, they help keep premiums affordable while still providing full-value protection.

To get the most benefit from your coverage,

we strongly recommend that shippers opt for full coverage at the time of shipment entry. This is because TLI does not file separate claims with both the motor carrier and the insurance provider. Instead, our insurance partner will offer settlement, and then pursue recovery from the motor carrier on their end as well. This streamlined process speeds up your claim and simplifies your experience—while still holding carriers accountable behind the scenes.

**This list is not a complete list of all categories.

For additional categories, please reach out to TLI.

In some situations—especially when damage is minimal or below the deductible—it may make more sense for TLI to file a claim directly with the motor carrier. For example, if only one box on a pallet is damaged and the value of that loss is less than or close to the deductible, we can file the claim with the motor carrier on your behalf. This allows you to potentially recover the full amount without paying a deductible at all. Our team will help assess each case individually and determine the best path forward to protect your interests and reduce your out-of-pocket cost.

Please Note:

The deductible amounts listed above are based on rates at the time of this webpage’s creation and are subject to change based on the insurance provider used. Since multiple vendors power TLI Advantage+ coverage, deductibles may vary depending on the provider selected at the time of booking, along with the commodity being shipped. This table is provided as a guideline only.

All insurance-related decisions—including coverage limits, deductibles, and rates—should be reviewed and confirmed during BOL creation, or discussed with a TLI rep during the quoting phase of routing. Quotes can be provided prior to booking. Please note that changes after load tendering are difficult, and in many cases, not possible, so it’s important to finalize insurance details before dispatching the load.

Ready to Enjoy Peace of Mind?

Don't wait for something to go wrong. With

TLI Advantage+, you gain a proactive layer of defense that saves you time, money, and stress. Protect your shipments across all modes—domestic or international—with smarter, affordable coverage built right into your shipping tools.

For questions or help enabling insurance on your shipments, reach out to your TLI rep today. We're here to make sure your freight gets the protection it deserves.

Frequently Asked Questions (FAQ)

TLI Advantage+ is our freight insurance service, built into ViewPoint TMS and supported by trusted insurance providers like Redkik and Falvey. It gives shippers full-value coverage options that goes beyond limited motor carrier liability.

Is TLI an insurance company?

No. TLI is the highest rated 3PL on Google. TLI has a managed logistics division and a freight brokerage division. TLI is not an insurance provider. We partner with top-rated insurance vendors to deliver integrated shipping insurance solutions through our TMS platform.

How do I add freight insurance to my shipment?

It’s simple. When you create a BOL in ViewPoint TMS, just enter the shipment’s declared value. The system automatically calculates the carrier’s cargo liability and adds the extra insurance needed.

What does TLI Advantage+ cover?

TLI Advantage+ offers broad protection with fewer exclusions. It covers full shipment value—including damage, loss, or theft—across multiple freight modes: LTL, TL, PTL, Intermodal, Expedited, and International.

Is this better than just declaring excess value with the carrier?

Yes. Declaring excess value with a carrier often costs more and still leaves gaps. TLI Advantage+ offers best-in-class coverage at a lower cost, with faster claims resolution and broader protections. Likewise, the solution is built directly into BOL order entry, so no need to add a lengthy new process to get proper coverage.

How long do claims take to resolve?

Claims under TLI Advantage+ are typically settled within 120 days. Our vendor partners and team work together to move quickly and minimize stress for the shipper.

Can I use this insurance for truckload or international freight?

Absolutely. While LTL insurance is integrated into ViewPoint TMS, TLI Advantage+ is also available for Truckload, Partial Truckload, Intermodal, Expedited, and International shipments. Just ask your rep. It is critical to ensure full coverage prior to load tendering.

What are the risks of not adding shipping insurance?

Without insurance, you're limited to the carrier’s liability rules—often just $0.10 to $2.00 per pound. This won’t cover most losses, especially for high-value freight. If something happens, you may recover little or nothing. Many shippers are shocked if they get a volume LTL claim to only see $0.50/lb coverage, this is why gathering insurance off the front end is critical.

Is freight broker insurance the same as this?

No. Freight broker insurance

protects the broker. TLI Advantage+ freight insurance protects your freight. It ensures you, the shipper, have coverage if your shipment is lost or damaged.

What does it mean when a POD is "signed clear"?

A signed clear POD means the receiver signed for the freight without noting any visible damage or loss on the delivery receipt. Carriers interpret this as confirmation that everything arrived in perfect condition. This can make filing a claim more difficult or even disqualify you from recovery under standard carrier liability rules. Motor carriers typically require notificaiton of concealed damage within 24 hours, and in extreme cases may offer small settlements up to five days after notification.

Is “Subject to Inspection” enough to protect my claim?

No. Writing "Subject to Inspection"or "STI" on a POD is still treated as a clear POD by most carriers and insurance providers. It doesn’t document actual damage or shortages and does not extend claim rights or the time to file the freight claim. If there is any visible issue at delivery, it must be clearly noted on the delivery receipt with specifics. And if concealed damage occurs we must be notified right away.

How long do I have to file a claim with TLI Advantage+?

With TLI Advantage+, shippers can file a freight claim with a POD notated as damaged within 9 months. However, you have up to 60 days to file a claim—even if the POD is signed clear—if you acquired additional insurnace coverage through TLI Advantage +. This is far more generous than the typical carrier requirements, which often limit clear-POD claims to just 24–72 hours, and deny them altogether after 5 days.

Are there risks to filing late or with unclear paperwork?

Yes. While TLI Advantage+

gives more time, claims with unclear PODs, used equipment, or incomplete information may face longer processing times. And after 60 days, we can’t guarantee coverage if we are notified of a claim when the proof of delivery was signed clear. The more accurate your documentation, the smoother and swifter your claim experience will be.