Understanding Transportation Procurement Fundamentals

Request for proposal processes in logistics differ significantly from other purchasing categories. Unlike static commodities, freight involves dynamic variables including fuel costs, capacity fluctuations, and regional market conditions. Successful procurement acknowledges these complexities while establishing clear performance expectations.

The Bureau of Transportation Statistics reports that for-hire truck transportation generates over 6.7% to US GDP annually across the United States.(1) The TSA measured $0.9 trillion or 3.5% of GDP from for-hire transportation. This massive market operates with thin margins and volatile capacity, making strategic sourcing essential for shippers. It is important to launch your pricing strategies with the correct templates, tools and technology to get the best pricing for your enterprise. TLI offers all the

RFP tools

you need to succeed.

Traditional bid events occur annually or biannually. However, leading organizations now adopt continuous improvement models. These approaches balance contract stability with market responsiveness, creating partnerships rather than transactional relationships. This also ensures, when partnered with TLI, that you have a solution in place for small projects, multiple distribution centers and core vendors along with both regional and national vendors across all your reoccurring modes of transportation.

Preparing Your Transportation Data

Data quality determines procurement outcomes more than any other factor. Incomplete or inaccurate shipment information leads carriers to inflate quotes, protecting themselves against unknown risks. Conversely, clean data enables precise pricing and confident commitments.

Start by aggregating twelve months of shipment history. Include origin-destination pairs, weight ranges, freight classifications, and accessorial requirements. This foundation allows carriers to model your network accurately and propose optimal solutions.

Many shippers underestimate the importance of volume accuracy. According to Federal Motor Carrier Safety Administration data, carrier operating costs vary significantly based on load characteristics. (2) Providing realistic projections builds trust and encourages competitive pricing.

Geographic density matters tremendously. Lanes with consistent volume support better rates than sporadic movements. Identify your core corridors and secondary routes separately, allowing carriers to offer targeted pricing strategies.

Segmenting Your Carrier Network Strategy

Structuring Competitive Bid Invitations

Request documents must communicate clearly while remaining flexible enough for carrier innovation. Overly prescriptive requirements stifle creative solutions, while vague specifications lead to misaligned proposals. In addition, carriers need to hedge for the unknown so not supplying all necessary information will not result in the best base pricing. This is why TLI has tools and templates to get the carriers completely informed so they know exactly what to expect working with your enterprise. We include detailed lane guides showing origin and destination facilities, cwt breaks, accessorial studies, volume projections, PCF utilization, and special handling needs. Transparency about your business helps carriers price accurately and commit confidently. Hidden requirements revealed later damage relationships and create billing disputes.

Service level agreements need explicit definition. Transit time expectations, on-time delivery standards, and communication protocols establish shared accountability. The Government Accountability Office emphasizes that clear performance metrics reduce conflicts and improve outcomes in transportation contracts, (3) this visibility at such a macro level is also compounded the more sophisticated and granular one operates in their RFP.

Allow carriers to propose alternative solutions. Sometimes providers identify efficiencies you haven't considered, such as excessive cargo liability requests, or consolidation opportunities for routing optimizations. Building flexibility into bid structures captures these insights.

Lowest cost rarely equals best value in transportation. Comprehensive evaluation considers reliability, financial stability, technology capabilities, and cultural alignment. These factors determine long-term partnership success. Carrier scorecards provide objective assessment frameworks. Weight factors according to your priorities, such as 40% rate competitiveness, 30% service history, 20% technology integration, and 10% sustainability practices. This structured approach prevents emotional decision-making.

Financial health warrants serious attention. Carrier failures disrupt operations and create emergency sourcing situations. Review operating ratios, debt levels, and insurance coverage to ensure partners can fulfill commitments. Technology compatibility grows increasingly important. Electronic data interchange, tracking visibility, and automated tendering streamline operations and reduce administrative costs. Providers lacking these capabilities create operational friction regardless of attractive rates.

Negotiating Win-Win Agreements

Implementing TMS Technology Solutions

Modern procurement platforms transform transportation sourcing from manual spreadsheet exercises into strategic processes. These systems manage bid events, analyze responses, and optimize carrier selections based on multiple variables.

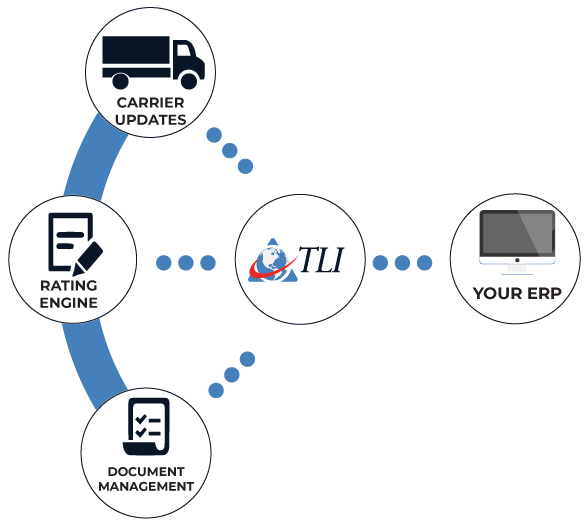

TLI offers technology that simplifies complex transportation decisions. Automated tools evaluate thousands of lane-carrier combinations instantly, identifying optimal networks that manual analysis would miss. This capability changes what's possible in procurement. This is especially pertinent concerning routing your inbound freight.

Measuring Procurement Success

Defining success metrics before starting bid events provides accountability and learning opportunities. Without clear measures, organizations struggle to improve their processes over time. Cost savings represent the most obvious metric but shouldn't stand alone. Calculate total landed costs including accessorials, fuel surcharges, and administrative expenses. Sometimes lower base rates come with hidden costs that negate apparent savings.

Service performance metrics track what matters operationally. On-time pickup and delivery percentages, claims ratios, and communication responsiveness indicate relationship health. These factors directly impact customer satisfaction and operational efficiency. Carrier diversity and relationship strength resist easy quantification but deserve attention. Over-concentration with single providers creates risk, while too much fragmentation prevents meaningful partnerships, and dilutes buying power. Balance supports both stability and competition, and TLI has the scenario planning tools to provide you with the best estimation to make strategic decisions.

Transactional procurement approaches miss opportunities for collaboration that reduce costs and improve service. Strategic relationships create value impossible in arms-length arrangements. Quarterly business reviews maintain engagement beyond annual bid cycles. These sessions address performance issues, discuss market changes, and explore improvement opportunities. Regular communication prevents surprises and builds trust.

Collaborative planning initiatives align your operations with carrier networks. Sharing forecast information helps providers position equipment effectively, reducing empty miles and improving asset utilization. These efficiencies translate into better freight rates and transport service.

Joint technology investments demonstrate commitment and unlock capabilities. Shared visibility platforms, automated scheduling systems, or sustainability tracking tools create mutual benefits that strengthen partnerships.

Leveraging Expert Support

Rigid procurement strategies fail when market conditions shift unexpectedly. Building adaptability into your approach protects operations during disruptions while maintaining strategic direction. Contingency capacity arrangements provide insurance against primary carrier failures. These relationships cost more than core network rates but prevent catastrophic service breakdowns. The investment pays for itself during crisis situations.

Market monitoring systems alert you to changing conditions that warrant procurement adjustments. Fuel price trends, capacity indicators, an economic forecasts inform tactical decisions within strategic frameworks. Communication protocols established during calm periods become essential during storms. Carriers appreciate shippers who understand market realities and work collaboratively through challenges rather than making unreasonable demands.

Complex procurement benefits from specialized expertise. Whether engaging consultants or utilizing platforms like ViewPoint TMS, professional support often delivers returns far exceeding costs. Expert resources powered by TLI bring market intelligence that individual shippers can't access. Benchmark data, rate trends, and carrier performance information inform better decisions and strengthen negotiating positions.

Process facilitation ensures bid events stay on schedule and follow best practices. Experienced guides prevent common mistakes while adapting approaches to your specific situation. Ongoing optimization support extends value beyond initial implementation. Transportation networks evolve continuously, and expert partners help you adapt strategies as your enterprise grows and changes.

Footnotes: