What Is Shipping Insurance?

Even if you have shipping insurance through another provider, managing claims yourself can still drain your time and resources. Filing disputes, chasing documentation, and arguing over liability can slow your team down. TLI’s managed logistics services take that burden off your plate.

Our team

handles freight claims, files disputes, and works directly with motor carriers to mitigate damages and losses. We do the heavy lifting so you can focus on scaling your operations. Instead of getting stuck in frustrating claims battles, you stay focused on serving your customers and growing your business.

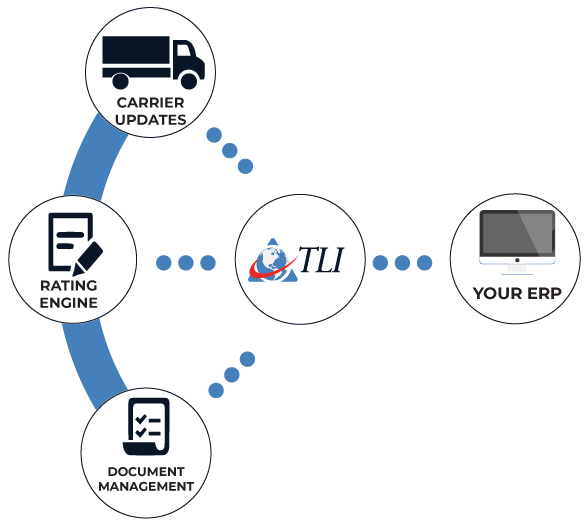

How ViewPoint TMS Simplifies Shipping Insurance

Cargo Liability Insurance vs. Contingent Cargo Insurance

Our Integrated Insurance Solution

Shipping insurance must be added before tendering the shipment. You cannot add coverage after the carrier picks up the load. Planning ahead ensures full protection without any last-minute headaches. If you have questions about cargo liability insurance or contingent cargo insurance, just ask! Our team can guide you through the best options based on your cargo type and transportation mode.

ViewPoint TMS makes it easy to plan, quote, and secure shipping insurance with just a few clicks. You get

peace of mind

without slowing down your operations.

FAQs About Shipping Insurance

What is the difference between cargo liability insurance and shipping insurance?

Cargo liability insurance covers carriers against claims of freight loss or damage. Shipping insurance offers broader protection to the shipper by fully covering the cargo’s value, even beyond carrier limits. Within ViewPoint TMS you can acquire additional shipping insurance to ensure your load is

fully insured even beyond default motor carrier coverage.

What is contingent cargo insurance for freight brokers?

Contingent cargo insurance for freight brokers protects brokers or 3PLs when a carrier’s primary insurance denies a claim. It acts as a secondary coverage option to protect against financial loss. Contingent coverage is not applicable on all modes nor all commodities so be sure to ask for clarity, if needed, prior to booking a load. Contingent cargo is used in extremely rare occurrences, such as when a carrier declares bankruptcy while there is an outstanding claim being disputed.

Can I add shipping insurance after the load is picked up?

No. All shipping insurance must be added ideally before the shipment is tendered and definitely before carrier pickup.

Are you one of the shipping insurance companies?

No. Translogistics (TLI) is not an insurance company.

We are a 3PL that offers integrated shipping insurance solutions through our ViewPoint TMS system to protect our customers’ shipments in transit.

Can I route shipping insurance through multiple transportation modes?

Yes! ViewPoint TMS can apply shipping insurance across LTL, Volume LTL, FTL, and other modes easily.