Transportation Trend - September 2023

Latest Update in Transportation Trends

September 2023

Freight Market conditions have indicators that the pendulum may be swinging again. Yellow Corporation and weather events last month are contributors to a lower performing LTL networks.

ViewPoint Update

ViewPoint now provides shippers with access to freight claims directly in the portal. File and view the status of freight claims in ViewPoint. To learn more, take a look at the latest release update here.

Yellow Corporation

Yellow Corporation’s bankruptcy last month left a hole in LTL Freight Shipment volumes as 10% of total LTL shipments went through their four companies. During talks with carriers, it appears that the volume was absorbed mostly by T-Force and ABF Freight due to Yellow’s reputation of handling undesired freight. However, all LTL carriers are seeing increased volume due to the bankruptcy and attributing to lower service levels.

Less-than-Truckload

Hurricane Idalia had impacted the southern states operations last week, with terminals in FL, GA, LA, and other southern states being set to limited or no operations. Outbound freight destined for FL in Texas terminals also was held up ahead of the storm. Operations was also affected more north as the storm moved through states once making landfall. Shippers may continue to see some impacts directly and indirectly from Hurricane Idalia in LTL networks.

Truckload

Industry indicators may be revealing a shift in the freight market. Freight rates have been favorable to shippers as capacity has been loose for most of 2023, even with rising freight volumes. This was marked by a low outbound tender reject index as carriers were covering freight to meet their operating costs without being picky.

However, as carriers begin to leave the market due to high operating cost / lower freight rates, the pool of available drivers becomes scarce and freight rates will begin to increase. The Outbound Tender Rejection has hit 4% for the first time in six months. Foreshadowing that the needle may be moving away from a favorable shipper’s market.

The rise of diesel plays a part in higher operating expenses that may drive carriers out of the market. In the last few weeks, the price of diesel raised in the past few weeks. While the price is lower than the peak last year, the higher price along with lower freight rates contributes to carriers leaving the market.

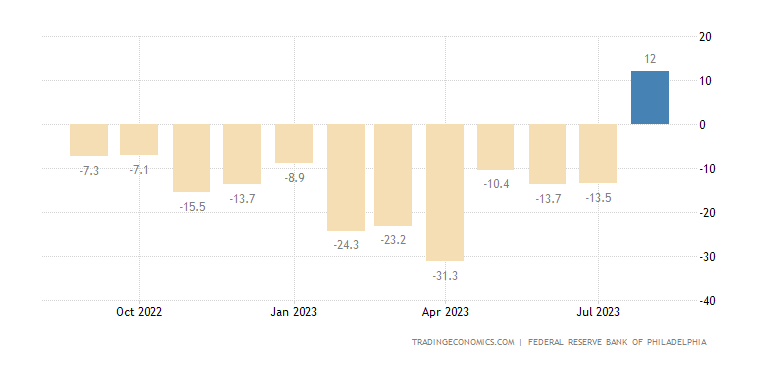

Chart of the Week (Manufacturing Index)

The Philadelphia Fed Manufacturing Index marks the first month of growth in Philadelphia's manufacturing activity since August 2022 and the strongest since April of the same year. The survey’s indicators for new orders (+16 vs -15.9 in July) and shipments (5.7 vs -12.5) were positive for the first time since May 2022. However, employment, on balance, declined further (-6 vs -1). Meanwhile, both the prices paid index (20.8 vs 9.5) and the prices received index (14.1 vs 23) stayed close to their long-term averages. Expectations for growth over the next six months were less widespread (3.9 vs 29.1), as most of the survey’s future indexes remained positive but declined. source: Federal Reserve Bank of Philadelphia

TLI Insights

Get the latest logistics insights and tips from TLI's award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@shiptli.com