TRANSPORTATION TRENDS: 3-20-23

TLI's Weekly Transportation Trends

Week of March 6, 2023

A quick look at the current numbers as the 1Q is winding down. The TL market seemed to have cooled immensely. LTL networks have lower organic demand, while some carriers continue to report that they struggle with higher volume in their networks.

Market Update:

Total freight shipments were up 4% from February to January, but freight expenditures were down 1% month-over-month and 6% from this time last year. Freight expenditures are seeing lower rates in the TL market spot rates contract and contract TL prices moderate.

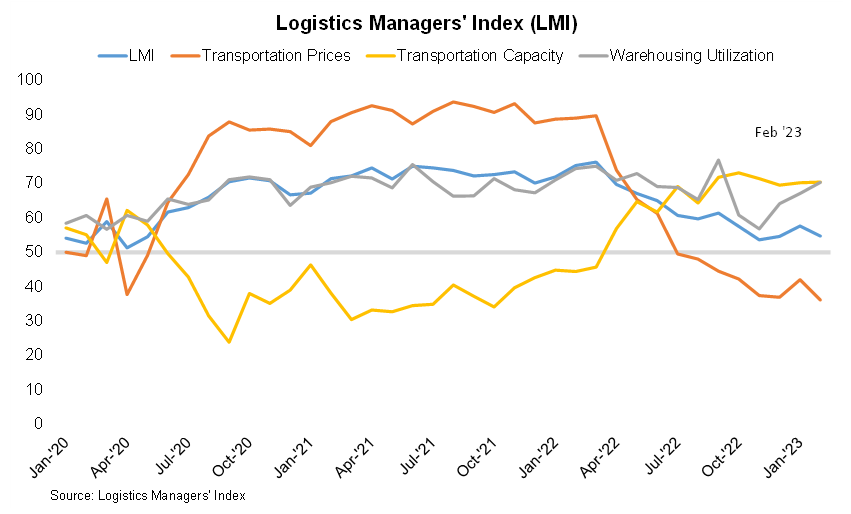

The logistics manager index (LMI) remained in growth territory last month. Transportation capacity, warehousing utilization, and the LMI stayed above 50, which indicates expansion. On the reverse side however, transportation prices stayed below 50, which indicates contraction. (Chart of the week)

Truckload:

The flatbed market showed the most up-tick in the load-to-truck ratio at +5.3% week-over-week and 9.1% month-over-month. This is in part due to the normal seasonality trend beginning to start. Dry Van and Reefer equipment continue with lower spot and contracted rates.

Less-Than-Truckload:

Overall demand has been softer in the LTL network since September due to weaker organic demand (Consumer Markets). Experts believe the 1Q showed decreased organic demand through normal seasonality that’s been lacking in past years.

Our team still notices that specific carriers are dealing with very high volume and continue to have significant delays at delivering terminals and enroute. LTL carrier performance through TLI metrics showed a decrease in On-Time Pickup and On-Time Delivery metrics of about 2% from January to February.

TLI is actively monitoring situations in the industry, such as acquisitions, embargos, and other industry disruptions. If a TLI client is directly affected by any of these events, your TLI representatives will reach out to discuss what this means for your account.

TLI highly suggests that on all shipments you provide our team with the “Must Arrive by Date” (MABD) as to when you need the product delivered. This will help us select the proper transit time / equipment type at the best current freight rate.

Please contact your Translogistics team at 610-280-3210 for any further questions.

*article written by Mitchell Kinek CTB, Sales/Marketing Executive, Translogistics. Any questions, please do not hesitate to reach out!

TLI's Industry Chart of the Week

TLI Insights

Get the latest logistics insights and tips from TLI's award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@shiptli.com