TRANSPORTATION TRENDS: 1-16-23

TLI's Weekly Transportation Trends

Week of January 16, 2023

A brief update after the holiday season: The truckload market tightened up and briefly had spot rates rise, while import volumes were nowhere near historical holiday peak season levels.

Fresh, New Look at TLI:

TLI's Website, social media pages, and logo recently underwent some changes. Take some time to look at our new look heading into 2023:

2022 Holiday Peak Season?:

2022's holiday season saw "a non-existent peak season" for import volume. As December's numbers finished up, imports were down 12% year-over-year and 1% month-over-month. Some reasoning for this drop during the season could be seen from prior month imports, such as the peak in May. This resulted in overstocking at warehouses, to keep supply chains full of product.

Truckload:

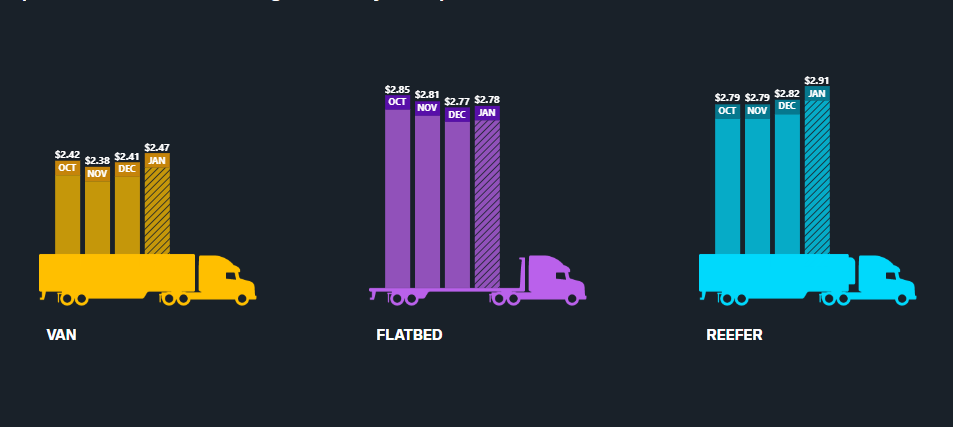

Spot rates have increased to start the New Year. According to DAT Trend Lines, capacity tightened a bit at the start of the year causing a $0.06 increase to national dry van rates - showed in the chart of the week. In the month of December, Spot Truck posts decreased 12.4% from November volumes while load posts increased 5.2% causing capacity tightness.

This past week has been a different story. Last week showed a huge increase in truck postings as the holiday season is over. Truck posts are up 67.6% while load posts are only up 13.9% week-over-week. The national load-to-truck average dropped from 5.49 to 3.70 week-over-week.

Less-Than-Truckload:

Continue to be on the lookout for consolidation in the LTL market. As announced 2 weeks ago, there was another acquisition with Forward Air announcing acquiring expedite LTL Provider Land-Air Express. As the market becomes smaller and competitive, carriers are looking for ways to break out from the competition with either purchasing additional equipment or finding new niches to gain more business.

LTL carriers are continually working through capacity issues on a terminal, shipment, and day-to-day basis. Weekly updates/directions are given by carriers to help alleviate their terminal which may include: freight embargos, dimension/quantity restrictions, and transit delays. TLI is actively monitoring these situations and will update any affected customer with solutions.

TLI is actively monitoring situations in the industry, such as acquisitions, embargos, and other industry disruptions. If a TLI client is directly affected by any of these events, your TLI representatives will reach out to discuss what this means for your account.

TLI highly suggests that on all shipments you provide our team with the “Must Arrive by Date” (MABD) as to when you need the product delivered. This will help us select the proper transit time / equipment type at the best current freight rate.

Please contact your Translogistics team at 610-280-3210 for any further questions.

*article written by Mitchell Kinek, Sales/Marketing Executive, Translogistics. Any questions, please do not hesitate to reach out!

TLI's Industry Chart of the Week

The chart above depicts national average line haul rates and fuel surcharges for equipment in the past 4 months, from DAT.

TLI Insights

Get the latest logistics insights and tips from TLI's award-winning team. Stay ahead in transportation planning.

Questions? Email us at marketing@shiptli.com